Property tax rates for the 2019-2020 school year have been proposed following action taken by the Caldwell County Board of Education.

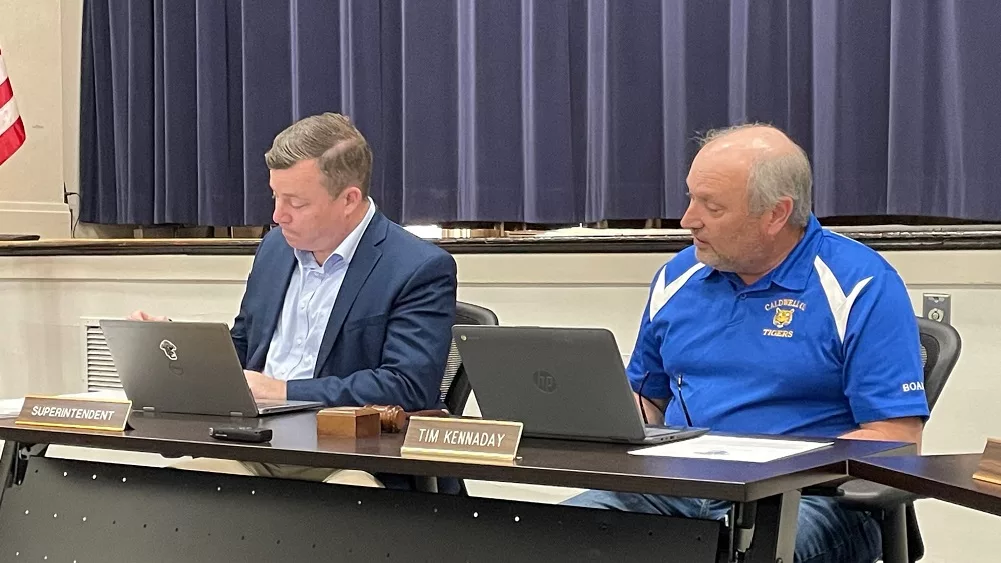

At a meeting Monday night Board Chairman Tim Kennaday proposed that the Board keep the previous year’s tax rate at 44.6%. During a special called meeting on August 12th Finance Officer Tammy Easley had explained that if the tax rate stayed the same there would be a $197,000 increase in revenue due to a recent increase in property assessment value. She added that the motor vehicle rate would stay at 53.8% while the utility rate would stay at 3%.

Following a second the Board unanimously approved preposing that tax rates stay the same for the 2019-2020 school year.

State law now requires that the Board’s decision be posted twice in the local newspaper before a public hearing is held and the tax rate can be approved and implemented.

The public hearing is set for Tuesday, September 10th beginning at 7PM at the Butler Building Auditorium in downtown Princeton.