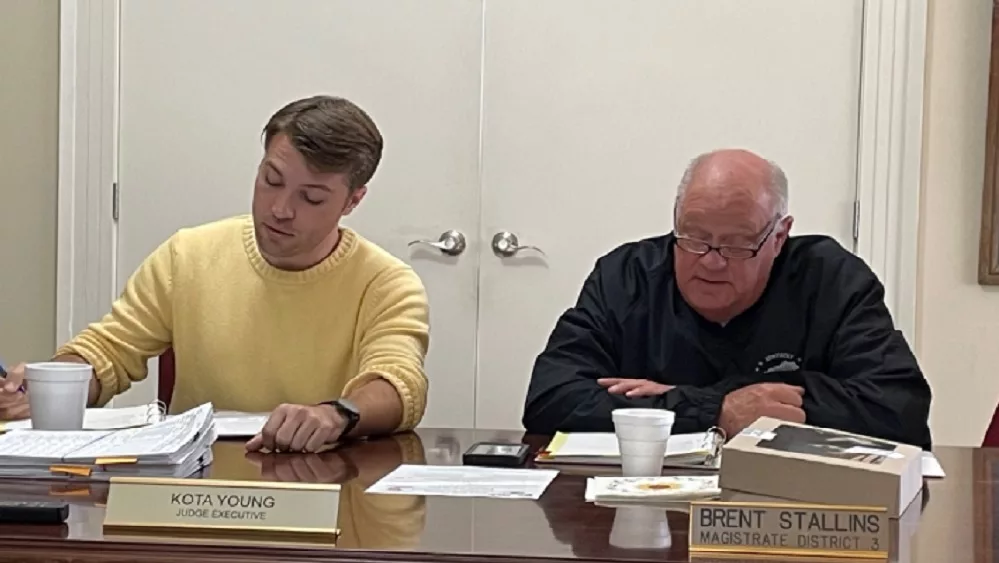

Three exceptions were found in the 2019 agreed-upon procedures (AUP) engagement of the Caldwell County Sheriff’s Office.

According to a release from State Auditor Mike Harmon on Thursday the three exceptions identified in the AUP engagement of Caldwell County Sheriff Stan Hudson were the sheriff’s operating disbursements exceeded the sheriff’s approved operating budget by $469, tax commissions were overstated by $19,623 due to the sheriff combining add-on fees with tax commissions on the fourth quarter financial statement, and the sheriff’s maximum salary order for deputies was overspent by $118,868.

In response to the first exception Sheriff Hudson explained his office was faced with ordering checks at the start of the tax season for disbursement for both the property tax account as well as the franchise account. He added over the previous years, a set fee of $100 had been automatically inserted into this box on the budget, however, this amount had not been taken out of the budgetary confinement and used from the line item. The checks were then pulled directly from the fee account therefore subtracting the amount directly and utilizing the budgetary line. Sheriff Hudson noted for the 2020 budget, the line item is being increased and a different means of ordering checks and deposit slips will be implemented.

In response to the second exception Sheriff Hudson noted the difference in the amount actually collected and the amount reported is due to combining add-on fees with tax commissions on the 4th Quarter Financial Statement, which was overlooked when transferring the numbers to their respective lines. He added corrective measures and awareness will be made to separate the totals so it does not look like a discrepancy in overage is shown.

As for the third exception Sheriff Hudson respectfully disagreed with the finding that the maximum salary order for deputies was overspent by $118,868, which is reportedly due to confusion over employer matching. He added his office has never employer-matched and after reviewing the fiscal court minutes he noted, The Annual Order Setting Maximum Amount for Deputies and Assistants form had not been filled out correctly. He explained the form was not the form that is customarily filled out and looks to be copied and pasted from the County Clerk’s form. It is his opinion the form was mistakenly marked and submitted to the fiscal court. Sheriff Hudson stated it is shown with examples provided from previous years his office is well within the maximum salary order for deputies had the “employer match” not been marked, therefore, he disagrees with the finding. Due to this current finding of the form being incorrectly filled out, Sheriff Hudson notes he will implement the corrective measure of filling out and initialing the form himself before submitting it to the fiscal court. He states doing so will avoid further confusion and the projection the sheriff’s office is not staying within the confines of the maximum salary order.

State Auditor Harmon’s release explains state law requires the auditor to conduct annual audits of county clerks and sheriffs but following legislation that took effect in July 2018, clerks and sheriffs who meet certain criteria may apply for an AUP engagement in lieu of an audit of their fee account. The intent of change was to reduce audit costs for sheriffs and clerks that have a history of clean audits while still maintaining an appropriate level of accountability. Sheriff Hudson applied for and received approval from the Auditor of Public Accounts to obtain an AUP engagement for the 2019 calendar year. Auditors then performed the procedures, which were agreed to by the sheriff, on receipts and disbursements, excess fees, record keeping, and leases, contracts, and liabilities for the period of January 1, 2019 through December 31, 2019. A summary was then provided in the report and identified the three exceptions for the Caldwell County Sheriff’s Office.

The sheriff’s responsibilities include collecting property taxes, providing law enforcement and performing services for the county fiscal court and courts of justice. The sheriff’s office is funded through statutory commissions and fees collected in conjunction with these duties.

The agreed-upon procedures report can be found on the auditor’s website here.