At Monday night’s meeting, Princeton City Council unanimously supported a 4% increase in property tax rates for 2023, which will result in lower rates compared to last year’s property tax rates.

In 2022, the city council set the tax levy at 16.9 cents on each $100 assessed value and 17.38 cents on each $100 of taxable personal property, which were the same rates as in 2021.

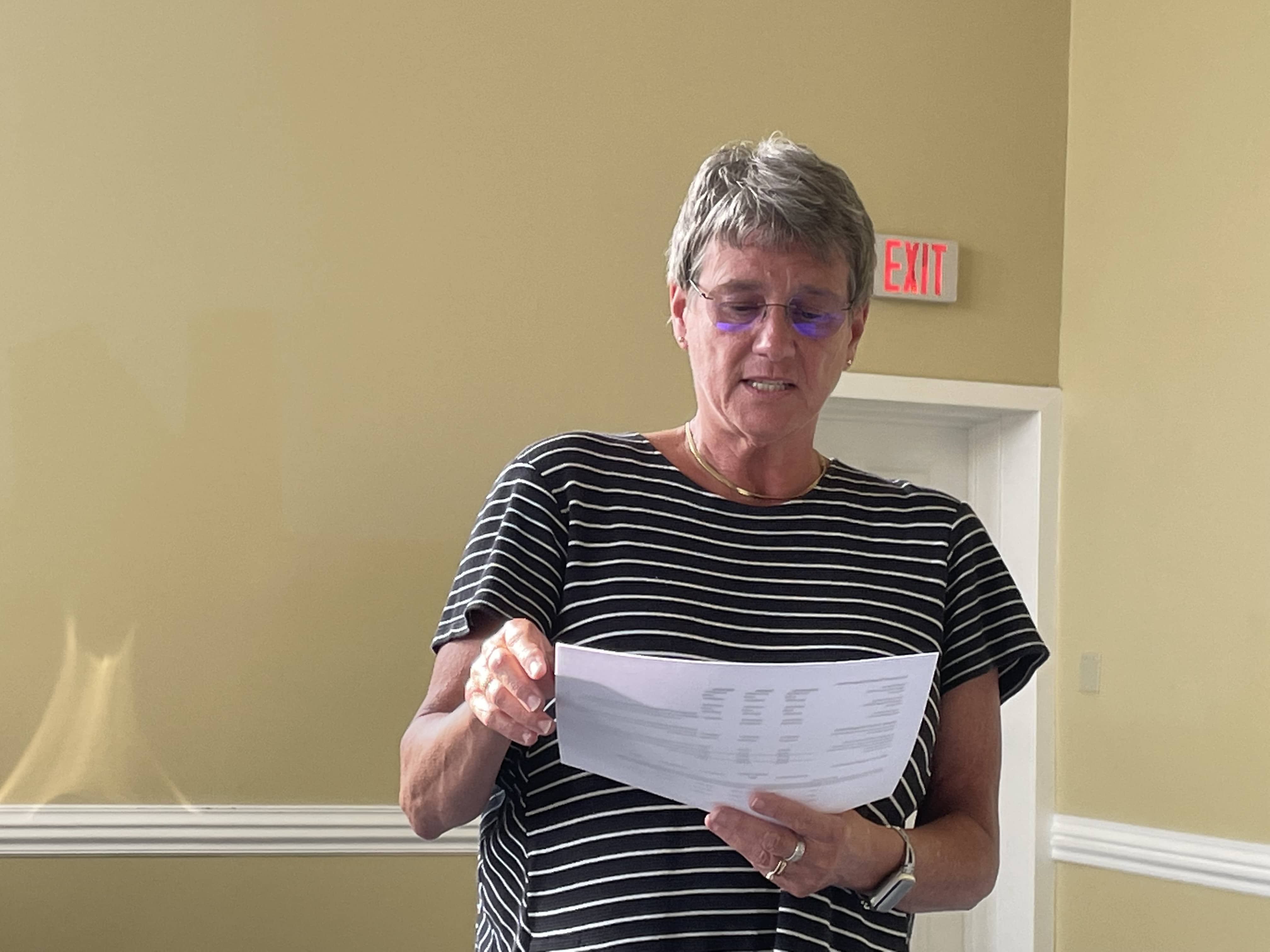

During the meeting, Director of Finance Stacy Boone informed the council about a significant increase in property assessments for the current year. She then presented the proposed tax rates, which included 16.8 cents per $100 of real property assessment and 15.4 cents per $100 of taxable personal property. Additionally, she noted the compensating rates of 16.2 cents per 100 of real property assessment and a compensating tax rate of 14.8 percent for personal property.

click to download audioBoone pointed out that even if the city implements the 4% tax rate on a property assessment of $150,000 and a tangible assessment of $150,000, she said the property tax bills will still go down.

Councilman Brian Conger made a motion to take the 4% increase, which was endorsed unanimously by the city council on the first reading.

In other new business, the council unanimously approved an amendment to the code of ordinances concerning nuisances in the city. The amendment specifically addresses the definition of a “Motor Vehicle or Machinery Junkyard” as any location where twelve or more abandoned, inoperative, or junked motor vehicles, along with automobile parts, scrap, or salvage materials, are deposited, parked, placed, or situated.

The amendment to the ordinance comes after a recommendation from Princeton Code Enforcement Director Alan Getz.

The council also approved a ten-year franchise agreement with Atmos Energy on the first reading, an interlocal agreement with the fire department, and the Fiscal Year 2024 Municipal Road Aid Agreement in the amount of $137,313.

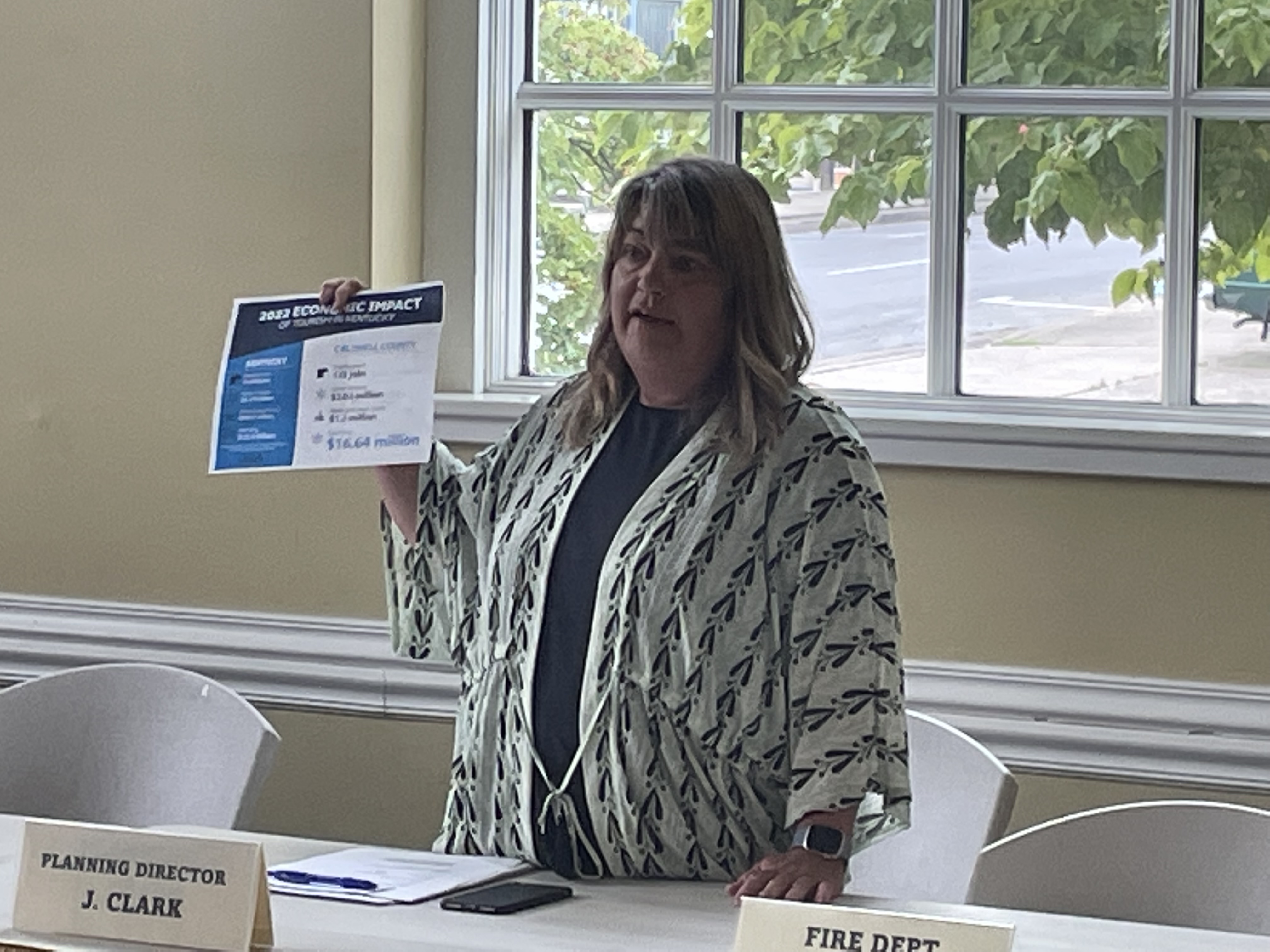

During reports, Planning Commission Administrator Jenny Clark shared the 2022 Economic Impact of Tourism in Kentucky which revealed spending in Caldwell County exceeded $16 million.

click to download audioThe research also showed that 135 tourism-related jobs were created in Caldwell County with a labor income just north of $3 million, and state and local taxes of $1.2 million.